Key Takeaways

- Global mining innovation creates value only when adapted to local geology, infrastructure, and regulatory realities.

- Cross-sector technology transfer and partnerships are critical accelerators for modern mining growth strategies.

- Systematic capability building and local ecosystem development turn one-off pilots into sustained competitive advantage.

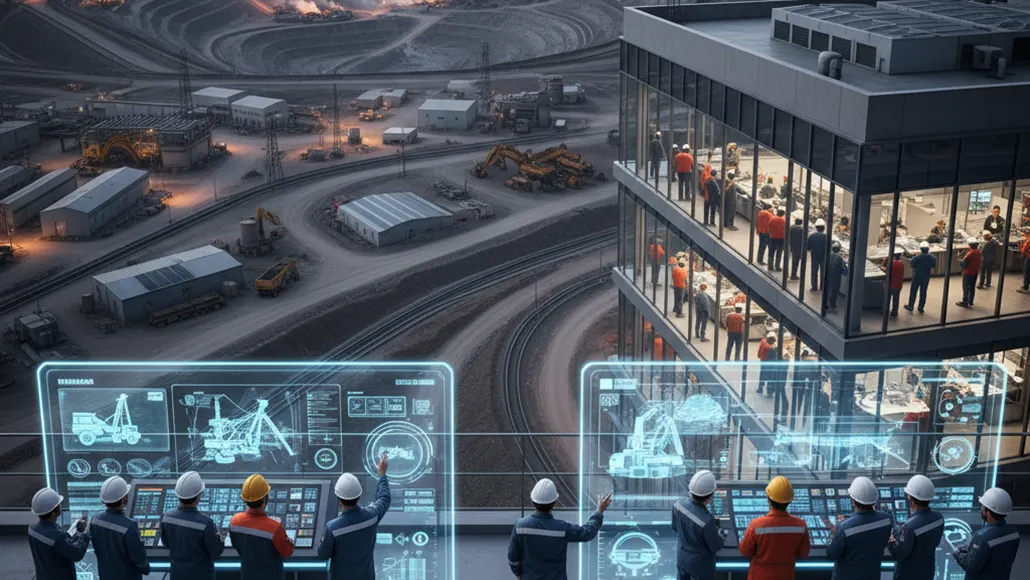

The mining industry stands at a crossroads where technology, sustainability, and geopolitics intersect. Across the world, innovation is reshaping how ore bodies are discovered, developed, and operated. Automation, electrification, digital twins, advanced analytics, and new processing techniques are moving from slide decks into operating mines. Yet the benefits of global mining innovation are unevenly distributed. Many regions rich in mineral resources struggle to translate international R&D and cross-sector breakthroughs into durable local mining growth strategies.

Bridging this gap is not a simple matter of importing equipment or copying best practices. Each mining region is shaped by its own geology, infrastructure, policy framework, labour market, and community expectations. Successful companies learn to act as translators between global mining innovation and the realities of local projects. Doing so requires a deliberate approach to technology selection, partnership building, knowledge transfer, and ecosystem development.

Understanding the Global Innovation Landscape

The starting point for any effective local mining growth strategy is a clear view of the global innovation landscape. In recent years, international mining R&D has been dominated by a set of common themes: decarbonisation, safety, productivity, and social performance. Automation and remote operations aim to remove people from high-risk environments while improving consistency. Electrification and alternative fuels seek to reduce greenhouse gas emissions. Digital transformation promises better decisions through data integration and analytics. New processing routes are being explored for complex ores and critical minerals.

However, these trends do not manifest uniformly. Some jurisdictions prioritise low-carbon technologies in response to carbon pricing and investor expectations, while others focus on productivity to remain competitive in bulk commodities. Technology clusters in countries with strong OEMs and research institutions develop specialised capabilities – for example, underground automation in Nordic countries, or bulk materials handling in Australia.

Mining companies seeking to harness global mining innovation must therefore be selective. The goal is not to chase every emerging technology, but to identify those that directly support the specific growth levers and constraints present in a given region or portfolio.

Aligning Innovation with Local Growth Levers

Local mining growth strategies are shaped by a handful of structural factors: orebody characteristics, infrastructure and energy availability, regulatory and fiscal regimes, workforce capabilities, and community expectations. Global mining innovation becomes powerful when it is aligned with these local realities.

In regions with deep, high-grade underground deposits but constrained ventilation capacity, for example, electrification and automation of underground fleets may be the most relevant focus area. In remote open-pit operations constrained by logistics and power costs, microgrids, renewable integration, and digital mine planning could offer a better return. Where social licence is fragile, technologies that improve water efficiency, waste management, and transparent reporting might be the key enablers of growth.

Effective strategy begins with a diagnosis of where the bottlenecks and opportunities lie. Once those are clear, global mining innovation can be scanned for solutions that address them. This disciplined approach prevents technology selection from becoming a fashion exercise and instead ties it to measurable outcomes such as lower unit costs, higher recovery, reduced emissions, or accelerated project schedules.

Cross-Sector Technology Transfer

Some of the most transformative tools in mining do not originate in mining at all. Cross-sector technology transfer has historically brought advances from aerospace, automotive, defence, and manufacturing into pits and plants. Sensors, communication systems, robotics, and AI platforms often begin life in other industries and then find new roles in mining.

Companies that excel at local mining growth strategies pay close attention to developments beyond their traditional vendor base. For instance, industrial IoT platforms built for factories can be adapted to monitor mining equipment. Navigation and collision avoidance systems from autonomous vehicles can be tailored for haul trucks and loaders. Water treatment technologies from municipal or chemical sectors can be reconfigured for mine effluent and tailings water reuse.

The challenge is that off-the-shelf solutions rarely drop perfectly into mining environments. Harsh conditions, regulatory standards, and complex legacy systems demand careful integration. Close collaboration between technology providers, local engineering firms, and mine operators is required to adapt and stress-test solutions. When done well, cross-sector technology transfer can leapfrog incremental improvements and give early adopters a distinct competitive edge.

Building Strategic Technology Partnerships

Individual mining companies cannot keep pace with the full breadth of global mining innovation on their own. Strategic partnerships help spread risk, pool expertise, and accelerate deployment. These can take multiple forms: joint R&D programmes with OEMs and universities, consortia between multiple miners to trial new technologies, or innovation alliances that include governments and development agencies.

For emerging markets and regions developing new mining clusters, partnerships are especially valuable. International mining R&D collaborations can provide access to cutting-edge knowledge while anchoring new facilities such as test mines, pilot plants, or training centres in the host country. Over time, such initiatives build a foundation for local innovation capacity rather than perpetuating dependence on imported solutions.

When designing partnerships, governance and incentives matter. Clear intellectual property frameworks, shared performance metrics, and agreed pathways from pilot to scale help prevent promising concepts from stalling. Successful partners recognise that the ultimate objective is not simply to run demonstrations but to embed global mining innovation into repeatable, bankable local mining growth strategies.

Developing Local Ecosystems and Supplier Networks

Technology on its own cannot deliver sustainable growth. Local ecosystems and supplier networks must evolve alongside it. Localisation in mining is increasingly expected by host governments and communities, not just in terms of employment but also through value-added manufacturing, services, and innovation.

One practical approach is to develop mine cluster development initiatives, where several operations and projects in a region coordinate their needs and long-term plans. This aggregated demand can justify investments in shared infrastructure, specialised training programmes, and local manufacturing capabilities. For example, a regional hub for mining equipment maintenance, digital services, or component assembly can emerge when there is a critical mass of demand from multiple mines.

Innovation hubs for mining – often linked to universities or technical institutes – can provide a focal point for start-ups, researchers, and established suppliers to collaborate on challenges identified by industry. Incubators and challenge-driven competitions can surface local entrepreneurs who adapt global mining innovation to local contexts, while anchor customers from the mining sector provide the market pull.

Local supplier development programmes complement these efforts. By offering technical assistance, quality management training, and access to financing, mining companies can help regional suppliers meet the standards required to participate in global value chains. Over time, this builds a more resilient, diversified ecosystem that supports both operational excellence and broader economic development.

Capability Building and Knowledge Transfer

Even the most sophisticated technology fails without the right skills and organisational culture. Bridging global mining innovation and local mining growth strategies requires systematic capability building at multiple levels.

On the technical front, training programmes must move beyond one-off sessions tied to equipment delivery. Continuous learning pathways for operators, maintainers, engineers, and managers are essential, encompassing both formal instruction and on-the-job coaching. Partnerships with vocational institutes and universities can align curricula with the emerging skillsets demanded by automation, digital systems, and advanced processing.

Leadership and governance capabilities are equally important. Decision-makers need to understand how to evaluate innovation investments, manage risk, and design portfolios of pilots and deployments. Tools such as stage-gate processes, technology readiness level frameworks, and benefit-tracking dashboards help create transparency and discipline.

Effective knowledge transfer mechanisms ensure that lessons from early adopters and international reference sites are captured and shared. Communities of practice, cross-site secondments, and digital knowledge platforms all contribute to avoiding repeated mistakes and accelerating learning curves across operations.

Embedding Sustainability and Community Value

Global mining innovation is increasingly intertwined with sustainability imperatives. Technologies that reduce water use, improve tailings stability, lower emissions, and enhance transparency are at the forefront of international mining R&D agendas. Local mining growth strategies that ignore these dimensions risk regulatory friction, social opposition, and stranded assets.

Integrating sustainable mining practices into growth plans means selecting innovations that not only drive productivity but also enhance environmental and social performance. Remote monitoring of tailings facilities, advanced dust control systems, renewable energy integration, and transparent community reporting platforms are examples of solutions that align global mining innovation with local expectations.

Crucially, communities should not be passive recipients of technology decisions. Structured engagement processes, participatory planning, and local benefit-sharing arrangements help ensure that innovation translates into visible improvements in livelihoods, infrastructure, and environmental stewardship.

From Pilots to Scalable Growth Platforms

Many mining organisations have experienced pilot fatigue – a proliferation of small-scale technology trials that generate interesting results but never progress to full deployment. Turning promising experiments into scalable growth platforms is the final step in bridging global mining innovation with local mining growth strategies.

This requires a deliberate portfolio approach. Companies must differentiate between exploratory pilots meant to build understanding, proof-of-concept trials designed to validate a business case, and rollout projects that embed technologies into standard operating procedures. Funding mechanisms, governance, and performance expectations should be tailored accordingly.

Standardisation plays a key role. Once certain technologies prove their value, creating common architectures, interfaces, and data models allows deployments to be replicated across sites with fewer customisations. Shared centres of excellence can provide design templates, vendor frameworks, and implementation playbooks.

In the long term, the most successful mining companies will be those that treat innovation not as an occasional project but as a core competency embedded in how they plan, build, and run their assets. By systematically connecting the strengths of global mining innovation ecosystems with the nuances of local geology, infrastructure, and society, they can unlock growth that is both economically robust and socially legitimate.