BHP Mitsubishi Alliance (BMA) joint venture partners BHP and Mitsubishi Development Pty Ltd (Mitsubishi) have confirmed completion of the sale of the Gregory Crinum Mine in central Queensland, to Sojitz Corporation for A$100 million.

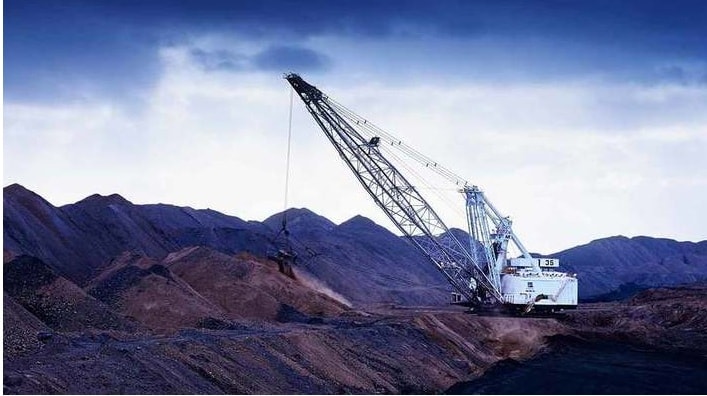

Gregory Crinum is a hard coking coal mine located 60 km north east of Emerald in the Bowen Basin. The site comprises the Crinum underground mine, Gregory open cut mine, undeveloped coal resources and on-site infrastructure including a coal handling and preparation plant, maintenance workshops and administration facilities.

BMA Asset President James Palmer praised the opportunity the sale presents for the region, as well as more broadly across Queensland.

“We wish Sojitz well in its plans to recommence production at Gregory Crinum. This will provide new job opportunities and trade benefits for the people of central Queensland, as well as increased royalties and taxes to benefit the state.’’

Gregory Crinum Mine’s capacity was six million tonnes of hard coking coal per annum when production ceased and it was placed into care and maintenance in January 2016.

BMA made the decision to sell the mine after a detailed review that concluded there is potential for another party to realise greater value at the mine.

In addition to the sale of the mine to Sojitz, BMA is providing appropriate funding for rehabilitation of existing areas of disturbance at the site, with all rehabilitation liabilities transferred to Sojitz. The net impact from this funding is not material for BHP or Mitsubishi.

Completion of the sale was subject to the fulfilment of conditions precedent including customary regulatory approvals.