The manganese mining industry stands at a pivotal juncture, driven by the surge in demand from diverse sectors such as battery manufacturing, steel production, and the chemical industry. The move towards clean energy and sustainable infrastructure globally implies that the disparate needs for manganese – the key material in most high-tech and industrial processes – are going to be geopolitical. In the next five years, the world manganese mining market will see impressive growth, driven by technological innovations, expanding applications, and increased supply chain investment. This report provides a comprehensive assessment of the current state of the manganese mining market, the future of the manganese mining market, and key drivers, challenges, and variations across regions, providing stakeholders with critical insights to navigate this rapidly evolving industry.┬Ā

Market Overview and Industry Dynamics┬Ā

The Manganese Mining Market was valued at USD 33.41 billion in 2024 and is forecasted to reach USD 37.62 billion in 2025, at a CAGR 12.24% to reach USD 66.84 billion by 2030. This trend is reinforced by the increasingly relevant usage of manganese in battery applications (notably EV batteries) in addition to its longer-established use in steel production (which still constitutes the backbone of infrastructure construction around the world).

The market value will be over USD 66.84 billion by 2030, due to increased mining and efforts to improve the processing technologies regarding material utilization (e.g. through technology upgrades to evolve processing techniques) and strategizing about control of critical supply chains. The sector is in flux, subject to a dynamic environment with the influence of geopolitical tensions affecting environmental regulations and commodity price cycles, thereby impacting production, investment flows, and technologies being adopted.

Product Types and Applications

The manganese mining industry is typically cast into two categories, ferroalloys and manganese ore. Manganese ore is the raw material mined that will be put through various processes and methods until it is converted to either ferroalloys or other manganese products. Ferroalloys, which are mostly manganese, are essential to steelmaking to convert plain carbon steel to improve strength, durability, workability, and other products that contain manganese to have other properties.

Among the uses, the most significant segment remains the steel sector, with about two-thirds of world manganese usage. Manganese is crucial in steel production to attain precise mechanical properties, and thus it is a fundamental material used in construction, automotive, and infrastructure development.

The chemicals industry also accounts for a major application sector, more so in the manufacture of manganese-based chemicals employed in water treatment, agriculture, and specialty chemicals. This is complemented by the rising demand from battery production, more so in lithium-ion and new battery chemistries, where manganese finds important application as a cathode material.

The development of electric cars and mobile energy solutions has created increased interest in manganese’s function in improving battery performance. This segment is projected to expand rapidly, with uses spreading beyond legacy applications into the renewable energy storage business and consumer electronics.

Distribution Channels and Market Segmentation

Distribution networks for manganese commodities differ considerably from region to region, ranging from direct sales by mining firms to industrial producers to a large network of chemical suppliers, traders, and distributors. Digital trading platforms and supply chain optimization software are anticipated to make procurement processes more efficient, diminish lead times, and enhance transparency.

The market is relatively segregated on the basis of manganese product purity. High-purity manganese concentrates, with applications mostly in battery production and chemicals, are high-priced and need sophisticated beneficiation processes. Medium and low-purity products are relatively used in steel production, and their pricing is highly controlled by world steel demand and metallurgical specifications.

Processing type is another crucial segmentation, differentiating between pyrometallurgical and hydrometallurgical methods. Pyrometallurgical processes involve high-temperature smelting, favored for large-scale ore beneficiation, while hydrometallurgical techniquesŌĆömore environmentally friendlyŌĆöare gaining traction due to stricter environmental regulations.

Mine type segmentation comprises open-pit and underground mining. Open-pit mining predominates based on its cost-effective nature and consideration of safety, though underground mining is utilized in areas with complicated geology or where ore bodies are found deeper.

Market Drivers and Trends

The leading motive motivating the manganese market is the rampant growth of battery capacity, specifically due to what is happening around the world in the rush to move towards electric vehicles. Manganese-based cathodes are essential in prolonging batteriesŌĆÖ lifetime, capacity, and safety, and therefore manganese becomes an indispensable ingredient of supply chains for the EV industry. The global trend of countries governing policies for the uptake of EVs and renewable energy will drive growing demand for manganese spent specifically on battery packs; to the extent that growth in capacity for traditional uses will be surpassed. Another major factor in this growth is the ongoing growth of steel production, especially in developing countries aiming to strengthen infrastructure and urbanization. The steel industry is the largest user of manganese, and new and additional steelmaking in Asia-Pacific, Africa, and the Middle East supports ongoing demand growth in that sector.

Environmental standards and green initiatives are also influencing the direction of the industry. Mining companies are adopting cleaner extraction and processing technologies to minimize environmental impact, satisfy stricter regulations, and develop sustainable sourcing practices.

Technological improvements in processing, ore treatment and recycling are paving the way to better resource management and improved recovery of high-grade manganese. Geopolitical factors such as resource nationalism and trade policy also impact supply chain strategy and encourage diversification and stockpiling.

Regional Market Outlook

Asia-Pacific

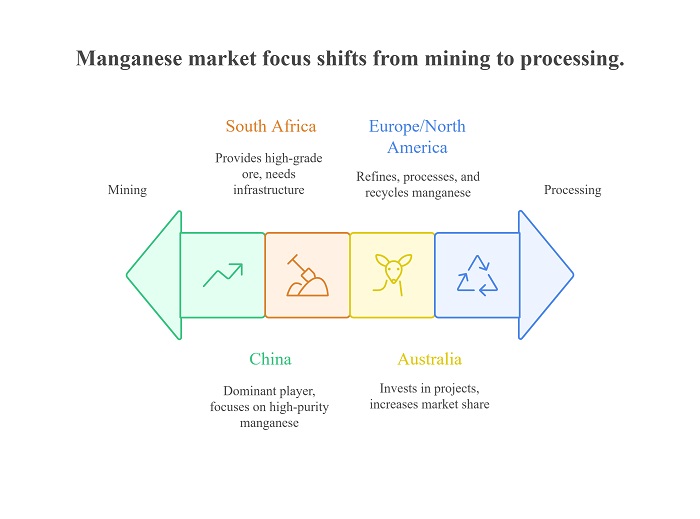

The region is the dominant player in manganese mining, benefitting from rapid urbanization, infrastructure development, and a burgeoning EV manufacturing sector. Countries such as China, India, and South Korea are leading the charge in augmenting their manganese ore mining capabilities and investing downstream, to process manganese ore in domestic factories. China remains the largest consumer as well as supplier of manganese, and continues to focus on producing high-purity manganese for batteries.

Africa

Africa, particularly South Africa, continues to provide high-grade manganese ore. The continent enjoys rich mineral deposits and changing mining policies to draw foreign capital while ensuring environmental issues are addressed. Future prospects will rest on geopolitical stability and infrastructure development to ensure export logistics. Australia is continuing to invest in manganese projects taking advantage of its abundant mineral endowment and technical expertise. Australia is now attempting to increase its market share in high-purity manganese production to address the growing battery market. Europe and North America

These regions are more focused on refining, processing, and recycling manganese. The continued launch of high environmental standards and growing interest in sustainable sourcing is also driving demand in these regions. The move towards green steel and battery production in these areas will likely increase domestic manganese demand .

Challenges and Future Opportunities

While the future is looking positive for manganese, there are numerous challenges facing the manganese industry. Global commodity price changes may challenge the price of the project and impact investment decisions. Environmental issues related to mining procedures, water consumption, and tailing disposal require innovative solutions for sustainable operations.

The increase in regulations and the push for ethical sourcing also prompt industry players to adopt rigorous standards, which might initially elevate operational costs. Additionally, the processing of low-grade ore remains energy-intensive, requiring technological advancements to improve efficiency.

However, they also pose opportunities. Green mining investments, recycling technology development, and digital monitoring system adoption can minimize ecological footprints and maximize efficiency. Strategic supply chain collaborations are crucial in order to maintain stable supply and satisfy growing demand.

Market Projections and Outlook

The global manganese mining industry is anticipated to grow at a CAGR of 12.24% throughout the forecast period. The increasing demand for batteries and improvements in infrastructure are expected to contribute to market growth. In 2030, the global manganese mining market value is anticipated to exceed USD 35 billion, and high-purity manganese products are progressively becoming the quickest growing manganese products sector.

The battery industry, specifically, will drive the industry growth, with the use of manganese in lithium-ion gaining importance. The continuous rise of green steel projects and rising emphasis on recycling will further support market forces.

The industry will also witness technological advancements to enhance yield, decrease environmental impacts, and boost the quality of manganese products. The sector will be more resilient and adaptable to shifts in the world economy as supply chains diversify and new reserves are found.

Conclusion

Technological, environmental, and geopolitical factors are driving the manganese mining industry’s robust development prospects at this significant juncture. Manganese’s versatility makes it an invaluable resource in the high-tech and sustainable industries of the future, from its crucial role in steel manufacturing to its expanding importance in battery technology.

The market is expected to grow at a positive compound annual growth rate (CAGR) over the next five years due to processing innovation and a greater emphasis on sustainable practices. The best-positioned businesses to benefit from this expansion will be those who make investments in sustainable inputs, diversified supply chains, and technology development.

Manganese mining will remain a key component of industrial growth as the world enters a decarbonization and digitalization era, shaping global infrastructure, transportation, and energy.┬Ā